The Hartford Re-Aligns Employer Markets Group To Strengthen Delivery Of Total Benefits And Retirement Plan Solutions For Empl...

November 24 2008 - 10:01AM

Business Wire

The Hartford Financial Services Group, Inc. (NYSE: HIG) is

announcing a new organizational structure for its Employer Markets

Group (EMG) to better serve the group benefits and retirement plan

needs of employers and their employees, optimize leadership talent,

and drive growth opportunities. EMG is part of the new

customer-centered organizational structure announced for The

Hartford�s life operations earlier this year and provides products

and services to 86,000 employers in the corporate, government and

non-profit markets. Through those employers, approximately 10

million employees are protected by The Hartford�s group life,

disability and accident coverage or participate in The Hartford�s

401(k), 457 and 403(b) retirement plans or both. �The goal of our

Employer Markets Group is to deliver a total financial solution to

employers,� said Jim Davey, executive vice president and director

of EMG. �In an uncertain economy, we can provide security against

sudden loss of income due to disability, the comfort of protection

through our life insurance products, and the tools to accumulate a

nest egg for retirement.� In an effort to surpass customer

expectations and make the most of new opportunities for providing

retirement plans and employee benefits, Davey announced a new

organizational structure: Jamie Ohl, senior vice president, will

lead the Retirement Plans Group (RPG). Previously, Ohl was

responsible for product development and business retention,

enhancing The Hartford�s overall product competitiveness. The

Hartford ranked among the top 10 providers in customer satisfaction

for mid-market plan providers, according to 401(k) Exchange. Ron

Gendreau, executive vice president, will continue to lead the Group

Benefits Division (GBD). Gendreau has directed the expansion of

GBD�s market share for group life and disability insurance.

According to LIMRA�s first quarter 2008 report on group benefits

sales, The Hartford retained its No. 1 ranking in fully insured

group disability sales that it has held since 2006 and holds the

No. 2 ranking in group life sales from the full year 2007 report.

Marty Swanson, vice president and chief marketing officer, will

lead marketing for both GBD and RPG. He is now responsible for

ensuring consistent messaging for the organization and uncovering

unique business opportunities across EMG�s markets. Harry Monti,

senior vice president, is responsible for leading operations and

service for EMG. In addition, Monti is charged with leading the

integration of RPG�s recent acquisitions and helping to develop a

multi-site strategy across EMG. In his previous role as head of

GBD's claim and service operations, Monti led GBD to impressive

customer and claimant satisfaction scores, with more than 90

percent of customers surveyed completely or mostly satisfied with

overall claim service. EMG brings together two dynamic,

fast-growing businesses that serve employers. GBD is a proven

industry leader and RPG has become one of the Hartford�s fastest

growing businesses. Earlier this year, The Hartford completed the

purchase of three retirement plans businesses. These acquisitions

illustrate the company�s commitment to serving all major markets,

customers and types of retirement plans across the defined

contribution and defined benefit spectrum. The three acquisitions

are TopNoggin of Powell, Ohio, a defined-benefit group that offers

top talent and cutting-edge technology; the Princeton Retirement

Group�s alliance business of Atlanta and Winston-Salem, N.C., which

brings private label capability and mid-market presence; and

SunLife Retirement Services of Boston and Phoenix, a defined

contribution record keeper that provides entry into the large

retirement plan market. Davey said EMG wants to stoke its

fast-growing group benefits and retirement plans businesses, in

part by making the most of complementary business opportunities

with employers and sharing best practices. Already, EMG has seen

those efforts pay off, he said. For example, The Hartford is a

leader in providing retirement plans to government employees

through its 457 plans. Tapping RPG�s knowledge in the government

market has helped GBD more than double its premium for group life

and disability coverage provided in this market, according to

Davey. �There are tremendous opportunities in the employer market

that The Hartford will be able to capitalize on going forward,�

Davey said. �Increasingly, employers are offering benefits such as

group life and disability coverage to employees on a voluntary or

contributory basis in much the same way that participants in

defined contribution plans have taken on increasingly more

responsibility for their own financial security. Both our group

benefits and group retirement plans businesses will be learning

from each other, improving how they can best serve the needs of our

customers.� About The Hartford The Hartford, a Fortune 100 company,

is one of the nation's largest diversified financial services

companies, with 2007 revenues of $25.9 billion. The Hartford is a

leading provider of investment products, life insurance and group

benefits; automobile and homeowners products; and business property

and casualty insurance. International operations are located in

Japan, the United Kingdom, Canada, Brazil and Ireland. The

Hartford's Internet address is www.thehartford.com. HIG-L Some of

the statements in this release may be considered forward-looking

statements as defined in the Private Securities Litigation Reform

Act of 1995. We caution investors that these forward-looking

statements are not guarantees of future performance, and actual

results may differ materially. Investors should consider the

important risks and uncertainties that may cause actual results to

differ. These important risks and uncertainties include those

discussed in our Quarterly Reports on Form 10-Q, our 2007 Annual

Report on Form 10-K and the other filings we make with the

Securities and Exchange Commission. We assume no obligation to

update this release, which speaks as of the date issued.

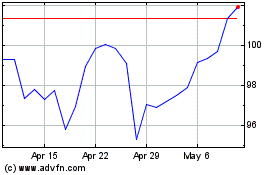

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2024 to May 2024

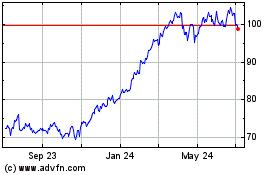

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From May 2023 to May 2024